Loan With Collateral: A Quick And Easy Solution

Posted on February 1, 2015

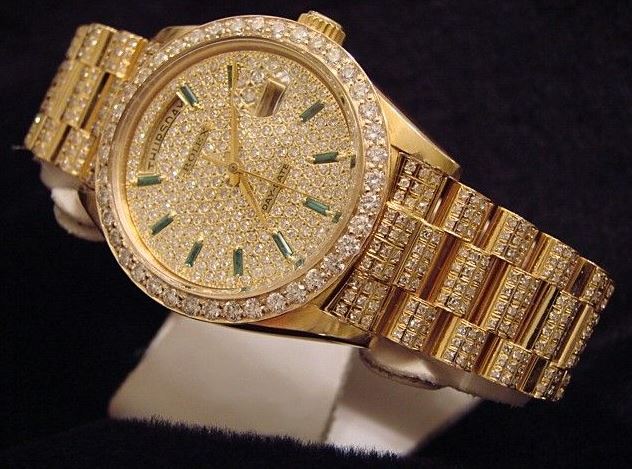

Are you looking to get a loan with collateral? A watch, diamond or jewelry piece perhaps? A collateral loan offers a quick and convenient financial solution that traditional bank loans cannot. At Jewelry-N-Loan, we specialize in offering loans against watches, diamonds and jewelry. It’s yet another service we provide in addition to buying, selling and trading, in order to fulfill all of our clients needs. To decide whether or not a collateral loan is the right solution for your financial needs, you need to know exactly what a loan of this type entails and the right way to go about getting one. We’ve listed the important details below. As always, if you want to discuss this in greater detail, you can contact Jewelry-N-Loan today for a free consultation.

A collateral loan offered at a pawnshop or pawnbroker can be a quick, convenient and confidential way for an individual to obtain a short-term, small loan at a usually lower interest rate. For this reason they are and have been for quite some time, a popular way for persons in need to receive the cash they require for any number of situations.

Simply put, a collateral loan works like this: customers pledge property as collateral and in return pawnbrokers lend them money. Once the customer pays back the loan and all interest accrued, their merchandise is returned to them. If the customer elects not to redeem his or her collateral, there is no credit consequence to the borrower and the pawnshop then can sell the item at a valued price to other retail customers.

At a reputable pawnshop, these loans are safe, secure and beneficial to all parties involved. Legitimate pawnbrokers are highly regulated and governed by several federal laws that apply to other financial institutions. In addition to federal laws and regulations, most pawnbrokers are licensed and regulated by state and local authorities as well. Always make sure you are dealing with a licensed pawnbroker before entering into any loan agreement.

Collateral loans with a pawnbroker are beneficial beyond their loan interest and short term rates. They are also beneficial to the consumer in that they impose a standard of discipline on the borrower that other unsecured loans do not. They do not cause people to overextend themselves on credit or go into bankruptcy as the loan is only given on collateral of an item of equal value.

Many pawnshops will offer collateral loans on several different items including electronics, firearms, musical instruments and much more. At Jewelry-N-Loan however we specialize in only giving loans on high-end watches, diamonds and/or jewelry. This higher standard and specificity means that you won’t find the traditional seedy part of the pawn business you may see in movies and television. We hold ourselves and our customers to a higher standard and only deal in legitimate, friendly, and honest transaction. When you visit our shop, the minute you step into our showroom and speak with our knowledgeable staff you will feel at ease and know you’ve made the right choice.

Our flexible and convenient cash loans do not require a credit check and remain strictly confidential. Our loans as with most pawnbrokers are short-term pledges and you can rest assured the are regulated by the Department of Justice. We are licensed and regulated and follow all laws and codes of conduct as mentioned above.

If you are in need of a quick and convenient loan, bring in your watches, diamonds and jewelry to our shop for a free consultation. As always, our reputation proceeds us and you can find plenty of positive reviews and testimonials online and by asking locally about Jewelry-N-Loan.

Contact Jewelry-N-Loan today by phone at 949.645.0488, through our website or come into our shop in Costa Mesa, CA. We are conveniently located near the right off the end of the 55 freeway at 1872 Newport Blvd., accessible easily from anywhere in Orange County or Southern California.